Once the province of U.S. tech hubs such as California’s Silicon Valley, venture capital has gone global. In a new report from the Martin Prosperity Institute, Rise of the Global Startup City, my colleague Karen King and I use detailed data from Thomson Reuters to track worldwide venture-capital investment in high-tech startups. Worldwide venture-capital investment amounted to $42 billion dollars in 2012 (the most recent year these detailed data are available), and is spread across more than 150 cities and metro regions.

The map below shows the world’s leading centers for venture-capital investment globally. The largest dots, indicating the largest levels of venture capital investment, are located in the East and West Coasts of the United States, Western Europe, and around the mega-cities of China and India. The U.S. is the world’s dominant center for venture capital, accounting for nearly 70 percent (68.6 percent) of total global venture capital, followed by Asia and Europe with roughly 14 percent each (14.4 percent for Asia and 13.5 percent for Europe).

Venture-Capital Investment by City

The table below lists the top 20 metros with the highest levels of venture-capital investment worldwide. The U.S. is home to the top six metros and 12 of the top 20. Taken together, these six metros—San Francisco, San Jose, Boston, New York, Los Angeles, and San Diego—account for roughly 45 percent of total global venture-capital investment. And two broad mega-regions—the San Francisco Bay Area and the Boston-New York-Washington Corridor—account for more than 40 percent of global venture investment.

Venture-Capital Investment by City

| Rank | Metro | Venture Capital Investment (millions) | Share of Global Venture Capital Investment |

| 1 | San Francisco | $6,471 | 15.4% |

| 2 | San Jose | $4,175 | 9.9% |

| 3 | Boston | $3,144 | 7.5% |

| 4 | New York | $2,106 | 5.0% |

| 5 | Los Angeles | $1,450 | 3.4% |

| 6 | San Diego | $1,410 | 3.3% |

| 7 | London | $842 | 2.0% |

| 8 | Washington | $835 | 2.0% |

| 9 | Beijing | $758 | 1.8% |

| 10 | Seattle | $727 | 1.7% |

| 11 | Chicago | $688 | 1.6% |

| 12 | Toronto | $628 | 1.5% |

| 13 | Austin | $626 | 1.5% |

| 14 | Shanghai | $510 | 1.2% |

| 15 | Mumbai | $497 | 1.2% |

| 16 | Paris | $449 | 1.1% |

| 17 | Bangalore | $419 | 1.0% |

| 18 | Philadelphia | $413 | 1.0% |

| 19 | Phoenix | $325 | 0.8% |

| 20 | Moscow | $318 | 0.8% |

| Top 20 Total | $26,790 | 63.6% | |

| Total – All Metros | $42,121 | 100.0% |

But, considerable centers of venture-capital investment have grown outside of the U.S. as well. With $842 million, London is the world’s seventh largest venture capital center. Toronto ($628 million) is 12th, and Paris ($449 million) is 16th. China and India are each represented by a pair of metros: Beijing ($758 million) and Shanghai ($510 million) are ranked ninth and 14th, while Mumbai ($497 million) and Bangalore ($419 million) are 15th and 17th.

* * *

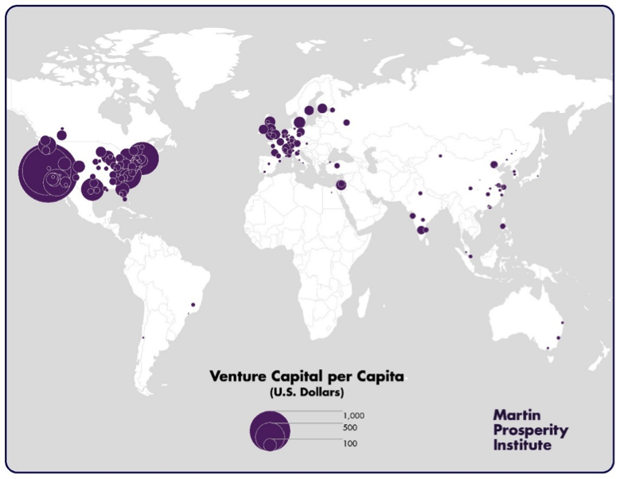

Larger metros like New York, London, and Beijing have an advantage based on their sheer size. To control for this, it’s useful to look at the amount of venture capital invested on a per capita basis.

The map above charts venture-capital investment per capita in leading global cities. Again, the largest dots are in North America on the East and West Coasts of the United States. There is also a sizable concentration of dots in Europe and a smattering throughout Asia.

Venture-Capital Investment Per Capita

| Rank | Metro | Venture Capital Investment per Capita |

| 1 | San Jose | $2,146 |

| 2 | San Francisco | $1,415 |

| 3 | Boston | $665 |

| 4 | Durham, North Carolina | $475 |

| 5 | San Diego | $434 |

| 6 | Austin | $323 |

| 7 | Seattle | $198 |

| 8 | Washington, D.C. | $138 |

| 9 | Jacksonville | $120 |

| 10 | Los Angeles | $110 |

| 11 | New York | $105 |

| 12 | Toronto | $104 |

| 13 | Salt Lake City | $102 |

| 14 | Madison, Wisconsin | $100 |

| 15 | Greensboro, North Carolina | $97 |

| 16 | New Haven, Connecticut | $93 |

| 17 | Denver | $90 |

| 18 | Oxnard, California | $89 |

| 19 | Providence, Rhode Island | $80 |

| 20 | Phoenix | $73 |

The table above lists the top 20 metros. Even on a per capita basis, the Bay Area continues to dominate. San Jose and San Francisco once again top the list, followed by Boston. But now, Durham in the North Carolina Research Triangle moves up to fourth place, followed by San Diego in fifth. Tech hubs like Austin, Seattle, and Denver also appear on the list, as does New York. Most notably, smaller metros across the United States such as Jacksonville, Madison, Greensboro, and New Haven join the list as well.

Outside of the U.S., Toronto is the only metro to make the top twenty. London, which ranked seventh on overall venture investment, drops down to 39th. Beijing, which ranked ninth in overall venture investment, now drops to 55th. And Mumbai, ranked 15th overall, drops to 70th when accounting for population. Other notable metros that fall out of the top 20 are Paris (53rd), Bangalore (43rd), and Shanghai (74th).

* * *

We’ve seen how venture capital investment is concentrated in a small number of metros worldwide. But how do the leading venture capital centers match up with the world’s dominant global cities?

To get at this, the table below compares the top 20 venture capital centers to the world’s most economically powerful cities.

Cities Ranked by Economy

| Metro | Global City Rank | Venture Capital Rank |

| New York | 1 | 4 |

| London | 2 | 7 |

| Tokyo | 3 | 54 |

| Hong Kong | 4 | 107 |

| Paris | 5 | 16 |

| Singapore | 6 | 79 |

| Los Angeles | 7 | 5 |

| Seoul | 8 | 37 |

| Vienna | 9 | 128 |

| Stockholm | 10 (tie) | 40 |

| Toronto | 10 (tie) | 12 |

| Chicago | 12 | 11 |

| Zurich | 13 | 97 |

| Sydney | 14 (tie) | 85 |

| Helsinki | 14 (tie) | 52 |

| Dublin | 16 (tie) | 50 |

| Osaka-Kobe | 16 (tie) | N/A |

| Boston | 18 (tie) | 3 |

| Oslo | 18 (tie) | N/A |

| Beijing | 18 (tie) | 9 |

| Shanghai | 18 (tie) | 14 |

| Geneva | 22 | 71 |

| Washington, D.C. | 23 (tie) | 8 |

| San Francisco | 23 (tie) | 1 |

| Moscow | 23 (tie) | 20 |

While there is some overlap between the two lists, they are by no means identical. New York, the world’s most economically powerful city, is fourth for venture-capital investment. Conversely, greater San Francisco—which is far and away the world’s leading venture-capital center—only ranks as the world’s 23rd leading global city. Twelve of the world’s leading cities rank among the top 25 venture-capital centers. Fifteen of the top 25 global cities rank among the world’s top 60 venture-capital centers.

* * *

The upshot is this: While some smaller places, mainly in the U.S., do well on a per capita basis, venture capital increasingly flows to large global cities, with all their density and dynamism. The leading centers remain the Bay Area and the Boston-New York-Washington Corridor, while a number of global cities outside of the U.S. have become significant centers for venture capital-backed high-tech startups: London, Paris, and Moscow in Europe; Toronto in Canada; Beijing and Shanghai in China; and Mumbai and Bangalore in India. Across the world, the top 10 metros account for more than half of global venture investment, the top 20 metros account for almost two-thirds, and the top 50 account for more than 90 percent. Ultimately, global venture investment is highly uneven and spiky, concentrated in a small number of leading cities and metros around the world.

Although venture-capital investment has certainly “gone global” by spreading to places like China and India, the dominant centers remain large U.S. cities that combine density, great universities, and the open-mindedness and tolerance required to attract talent from across the world. While cities like Mumbai, Bangalore, Beijing, and Shanghai have certainly shown their ability to attract venture investment and create startup ecosystems, their levels of venture capital remain well below that of the Bay Area, New York, and Boston. As of yet, these former cities are hamstrung by their inability to attract the world’s top talent. Outside of the U.S., the places that seem to have the brightest future as startup hubs are dense, diverse, global cities like London, Toronto, and Paris, which can effectively compete for talent on an international scale.

This uneven or spiky nature of investment and its flow to great cities marks a broader transition away from sprawling suburban campuses, or “nerdistans.” In recent years, innovation and entrepreneurship have returned to the great global cities and dense, diverse urban areas that have long served as fonts of creativity and invention. What once seemed like a shift toward suburban innovation and startup clusters in the late 20th century has proven to be a brief aberration from the long-held connection between density and innovation.

This post appears courtesy of CityLab.